Finance students come across several conceptual challenges during their course. One of such challenges is the confusion between capital budgeting and cash flow forecasting. While both of these tools are useful for making strategic financial decisions, they are used under different circumstances and serve differing purpose.

Capital budgeting is a method of evaluating possible major projects or investments with the intent of deriving their value. This could be anything from launching a new product to purchasing new equipment or expanding into a new market. On the other hand, cash flow forecasting is more concerned with the estimation of the cash inflows and outflows of a business during and over a given period which facilitates the balancing of liquidity and meeting the financial obligations of the company.

Both of these financial tools are essential in running and advancing a business, and its assets in particular. Students often get a variety of questions related to capital budgeting and cash flow forecasting in their course assignments. There are, however, instances where students may be confused about conceptual understanding and the appropriate cases where these tools are applicable. Our finance homework help service comes as a helping hand for students to resolve such confusing and complex problems in their finance assignments. Before we explain the benefits that you as students can derive by opting our services, let us first understand the basics.

What is Capital Budgeting?

Capital budgeting, also known as investment appraisal, is a process employed to evaluate the profitability prospects or financial feasibility of large investments or projects. It includes analysing the expected cash flows, identifying the cost of the initial expenses, and calculating key performance indicators such as NPV, IRR, Payback, and Profitability Index. These indicators are useful in determining whether a project should be undertaken or not.

For instance, if a firm is thinking of investing in a manufacturing plant, then capital budgeting would entail an estimate of the costs of construction of the plant, the anticipated increase of production capacity and the additional revenue it is going to generate. Using NPV and IRR, the company will be able to determine whether the investment is financially viable or not in the and be profitable.

A Journal of Corporate Finance study demonstrates that firms that apply more sophisticated capital budgeting methods are less prone to financial instability and more likely to have high profitability.

What is Cash Flow Forecasting (CFF) ?

Cash flow forecasting involves estimating the company’s cash inflows and outflows over a period of time mainly in months or quarters. This is useful in the day to day running of business activities as well as in ensuring that the business has adequate cash to meet its obligations. It assists in avoiding financial crunch situations and also in developing sound financial strategies.

For example, a hypermarket may apply CFF to plan for the period that they expect high traffic in business such as the festival season. With proper evaluation of the cash inflows arising from frequent sale and the cash outflows for the acquisition of more stocks, the retailer will always have adequate cash to meet the increasing demand. A study carried out by the Association for Financial Professionals whose participants include both small and big companies showed that while 93% of the companies use cash flow forecasting. This tool is very important for small businesses that are more likely to collapse due to poor cash flow management.

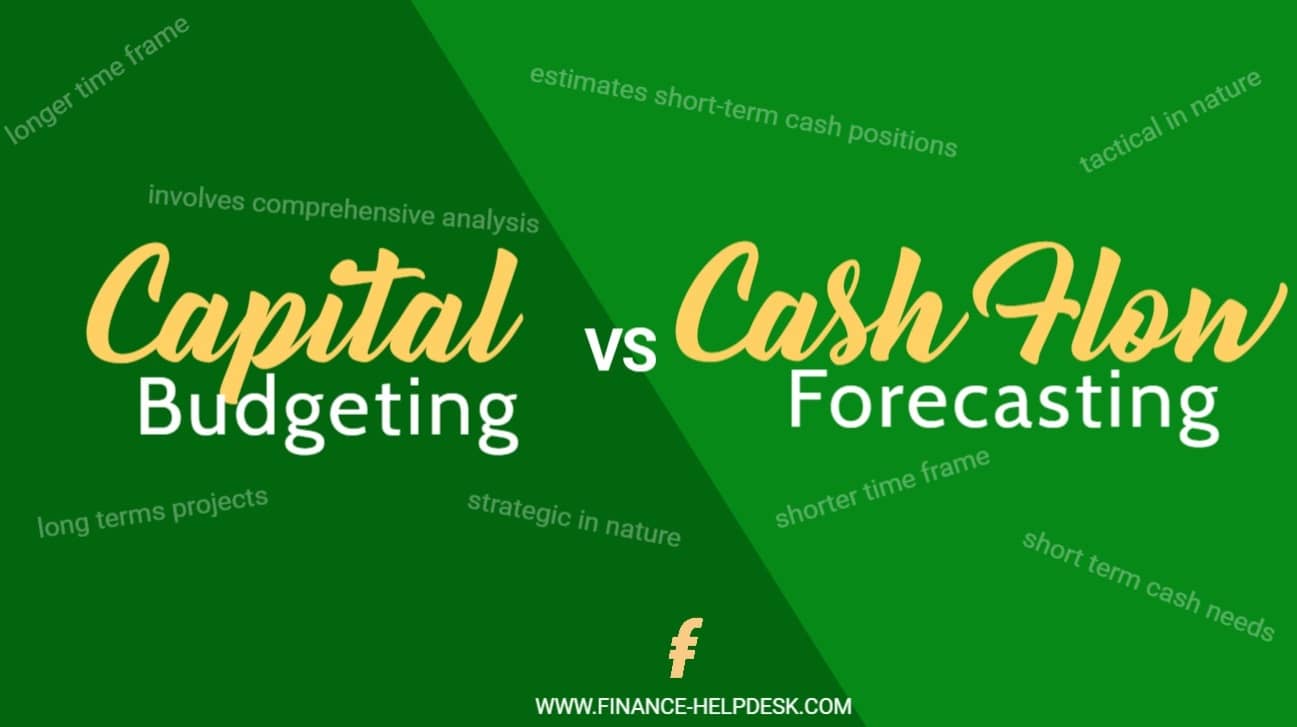

Capital Budgeting vs. Cash Flow Forecasting: Key Differences

While both capital budgeting and cash flow forecasting are essential for financial decision-making, they differ in several key ways:

| Capital Budgeting | Cash Flow Forecasting | |

| Purpose | Capital budgeting focuses on assessing the viability of long-term projects and investments and their potential returns. | Cash flow forecasting is all about predicting short-term cash needs and maintaining liquidity. |

| Time Horizon | Capital budgeting typically considers a longer time frame, often many years. | Cash flow forecasting usually covers a shorter period, such as weeks, months, or quarters. |

| Analysis Type | Capital budgeting involves comprehensive financial analysis to determine the viability of specific projects. | Cash flow forecasting is all about estimating short term cash positions to keep the company in a position where it can meet its obligations |

| Decision-Making | Capital budgeting decisions are strategic in nature, involving high investments and long-term planning. | Cash flow forecasting decisions are more tactical and short-term, stressing on day-to-day goals and cash management. |

Understanding these differences is crucial for students, as it helps them grasp when and how to use each tool effectively.

Challenges Faced by Students

Finance students often struggle with the concepts of capital budgeting and cash flow forecasting for several reasons:

1. Complex Calculations: Capital budgeting and cash flow forecasting both commonly involve complex calculations that needs a solid conceptual knowledge of financial mathematics and accounting. For instance, NPV, where future cash ?ows are discounted to the present value, which can be confusing for students unaware of the concept of time value of money.

2. Different Applications: It might be confusing for students to understand how capital budgeting is different from cash flow forecasting and when to apply each tool. This confusion leads to applying the wrong method into case studies and assignment problems.

3. Interpreting Results: Even if by taking some outside help in generating the results, the right interpretation can be challenging. For instance, a project with a high IRR may look attractive but students have to consider other factors such as risk and liquidity before arriving at a conclusion.

4. Time Management: Assignments involving these concepts are usually time intensive and students often fail to meet the deadline. This leads to unorganized and inaccurate work which affects the overall grade.

5. Understanding Assumptions: Both tools involve assumption of interest rates, demand in the market, and cost structures. However, justifying these assumptions and its effects on the analysis is sometimes difficult for students to explain or argue for.

How Finance Homework Help Services Can Assist

Under these challenging circumstances, students seek help from online finance experts in solving their homework. Our Finance Homework Help services come with great benefits to the student in grasping the concepts, performing the right calculations and writing accurate interpretations. Here are some ways our services can assist:

1. Top-Notch Guidance: Our team of finance assignment help experts comprise of a panel of professionals with years of experience on analyzing financial data. They provide step-by-step guidance on how to solve capital budgeting and cash flow forecasting problems without making any error.

2. Time-Saving: By getting fully worked out solution with detailed explanation, students can save their valuable time and focus on solving other important assignments and exams.

3. Improved Comprehension: By going through the detailed steps outlined in the solution and explanation that are usually written in layman terms helps a beginner student to comprehend the topics quickly.

4. Resources and Materials: Our finance homework help services also offer supplementary materials like sample questions, tutorials, and practice papers. These can be very helpful in strengthening the concepts and gain confidence to deal with exams.

Recent Examples and Case Studies

To further illustrate the importance of capital budgeting and cash flow forecasting, let’s look at an example:

Tesla in early 2020 revealed its intentions of constructing a new gigafactory in Berlin, Germany. This project called for massive investment in terms of capital and exhaustive planning. Applying the capital budgeting concept Tesla took an assessment of the new plant cost and revenues of the plant taking into account different aspects such as construction cost, tax benefits, demand of electric vehicles likely to be sold in the Europe. Positive NPV and IRR results indicated signs of positive returns from the investment. It formed the basis of decision to go ahead with the project.

At the same time, there is cash-flow planning that was necessary to maintain adequate cash reserves for construction without negatively impacting the company’s operations. Through predicting the cash inflows from sales and the cash outflows for the construction costs, Tesla ensured it did not experience any issues related to liquidity. The case demonstrates the value of capital budgeting combined with cash flow forecasting to support decision-making and guarantee business success.

Conclusion

In financial management, capital budgeting and cash flow forecasting refer to two different but equally crucial aspects in financial decision making. While capital budgeting makes it easier for businesses to determine the value of its long-term investments, cash flow forecasting assists in determining the liquidity required to fund the short-term activities of a business. As an academic and professional requirement these tools are very important for any student pursuing a finance career.

Analysing detailed financial data can be challenging due to its complexity. However, students can improve their understanding and performance by using resources like finance homework help services. With proper guidance, anyone can learn financial analysis and make informed strategic decisions.

Helpful Resources and Textbooks

For students looking to clear their concepts of capital budgeting and cash flow forecasting, here are some recommended textbooks and resources:

- Principles of Corporate Finance by Richard A. Brealey, Stewart C. Myers, and Franklin Allen

- Financial Management: Theory & Practice by Eugene F. Brigham and Michael C. Ehrhardt

- The Essentials of Finance and Accounting for Nonfinancial Managers by Edward Fields