The Global Financial Crisis (GFC) of 2007-2008 is considered as one of the most serious economic crises since the great depression. It began in USA and then gradually spread to other countries. This crisis raised suspicion and doubts related to stability and structure of financial systems globally. Analyzing the events of the crisis with the help of Keynesian economics is insightful. Keynesian economics prioritizes the role of aggregate demand on economic output and the importance of government intervention in the course of the economic crisis, is insightful.

The International Monetary Fund (IMF) reported a 2.1% decline in global GDP in 2009, with the U.S. economy contracting by 2.6% and unemployment reaching 10% in October 2009. The Eurozone was not spared either and recorded a 4.4% GDP contraction. Analyzing the main features of the GFC with the Keynesian concepts is valuable because it enhances the comprehension of the crisis’ origin and impact but prepares us for coping with future economic crises.

Financial economics students usually get challenging case study assignments and analytical questions crafted around the global financial crisis. Solving such tasks requires careful planning and thorough reading of the economics and financial concepts. Our financial economics assignment help service make things simple. We will discuss the advantages of opting for our services in the later part of this article. Let us now discuss the key kenynesian insights.

1. The Role of Aggregate Demand

The Keynesian economics proposes that the total demand for goods and services constitutes the total demand for products within an economy determines the economic growth and stability. The global financial crisis led to fall of aggregate demand due to the sudden slump of consumer demand and investment demand. According to Keynes, whenever there is a fall of aggregate demand, it is the duty of the government to implement intervention measures through fiscal and monetary policies.

Example: The U. S. government’s intervention measures in 2009 better known as American Recovery and Reinvestment act (ARRA) focussed on uplifting the aggregate demand. The ARRA assisted about 831 billion US dollars in form of tax cuts, benefits, and public investments to boost the economy and employment.

2. The Importance of Fiscal Policy

The Keynesian model stresses on the implementation of effective fiscal policy especially in a period of recession. As per Keynes, the government should take necessary steps to increase spending or offer tax rebates to strengthen aggregate demand to recover the economy. This strategy was apparent during the GFC since governments across the globe introduced large scale fiscal packages to withstand economic downturn.

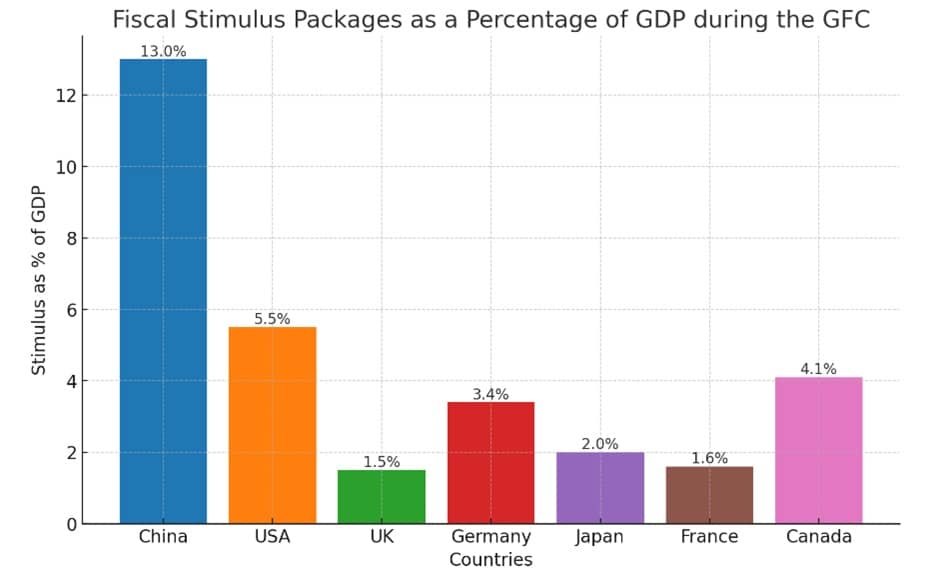

Graphical Illustration:

The above example bar graph is illustrating the approximate fiscal stimulus measures taken by various countries during the GFC as a percentage of GDP.

3. Monetary Policy and Interest Rates

Keynesian theory also proposed to the importance of monetary policy is controlling economic instabilities. During the GFC central Banks around the world reduced their interest rates close to zero so as to stimulate borrowing and investment. Low interest rates facilitated the increase in borrowings by individuals and businesses that boosted aggregate demand.

Case Study: The Federal Reserve’s response to the GFC included a series of interest rate cuts from 5.25% in September 2007 to 0-0.25% by December 2008. In addition to this, the Federal Reserve implemented some unconventional monetary policies in the form of quantitative easing to push liquidity into the financial system.

4. Liquidity Trap and Unconventional Monetary Policies

A liquidity trap is a situation where interest rates are low, and savings rates are high, hence making the traditional monetary policy ineffectual. According to Keynes, in such circumstances, it is appropriate to use unorthodox policy measures such as quantitative easing and forward guidance. In the course of GFC, several central banks such as Federal Reserve and ECB engaged themselves in these policies to restore the financial system.

Unique Perspective: The Bank of Japan’s experience of being in a liquidity trap in the early 1990s was of particular significance during the GFC. The Lost Decade of Japan depicted the possibilities and flaws of performing quantitative easing.

5. The Paradox of Thrift

The paradox of thrift in Keynesian economics suggests that that though saving is in the self-interest of the individual, but in the case of excessive saving it affects the aggregate demand and leads to economic contraction. In GFC, uncertainty made consumer and business to save more and reduce spending which affected the economy.

Recent Example: COVID 19 also had a similar effect on the savings rate with the US personal saving rate reaching to a high of 33.7% in April 2020. This led to a decline in the aggregate demand and as result governments had to come up with policies to stimulate demand.

6. Financial Market Instability and Uncertainty

Keynes also brought into focus the issue of risk or uncertainty associated with the financial markets and its effect on the investment. As evidenced during the GFC, heightened risk of insolvency of the leading financial institutions made it hard for credit markets leading to a sharp contraction in investment and spending.

Case Study: The collapse of Lehman Brothers in September 2008 raised uncertainty in the global financial markets. To tackle the instabilities in the financial markets the need for robust regulatory structure was proposed.

7. The Multiplier Effect

The multiplier effect is another Keynesian economic concept that explains how an initial increase in spending by the government can lead to a larger change in the economy. Spending measures taken by the government during GFC involved introducing stimulus packages that sought to leverage the multiplier effect to recover the economy.

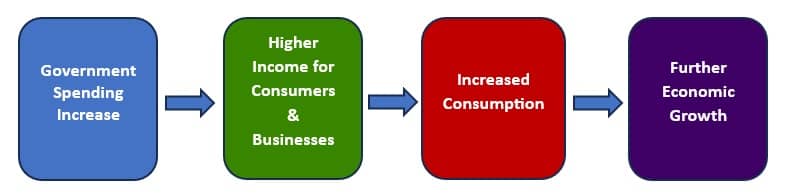

Graphical Illustration:

A flowchart demonstrating the multiplier effect shows how an initial government spending increase leads to higher income for consumers and businesses, increased consumption, and further economic growth.

8. Automatic Stabilizers

Measures like unemployment compensation and progressive tax policies act as automatic stabilizers to boost the stabilization of the economy with minimal intervention from the government. These stabilisers had a major role to play during the GFC by ensuring that the unemployed citizens are safeguarded and preserving the spending levels.

Unique Perspective: A study by the IMF found that automatic stabilizers contributed significantly in easing the adverse effects of the GFC for many leading economies.

9. Role of Expectations

Keynesian economics also highlights the importance of expectations in framing the behavior of the economy. In the case of GFC, negative sentiments about the future economic environment led to a decline in investments and spending resulting into economic contraction.

Example: The ’s forward guidance in 2013, was a policy measure focussed to boost positive sentiments about future interest rates to revive economic activity in the Eurozone.

10. Government Debt and Deficits

According to Keynes, government debt and deficits doesn’t necessarily pose any chanllenge during recessions. Keynes believed that during recession the government must aim to take measures to revive spending for economic revival rather than focussing on balancing the budget. Such a view was tangible during the GFC when most countries decided to implement large deficits as they sought to fund stimulus measures.

Recent Example: The U.S. government’s response to the COVID-19 pandemic saw a significant increase in the federal deficit, which reached $3.1 trillion in 2020.

Unlock Your Potential with Our Financial Economics Assignment Help

Financial economics has evolved as one of the toughest courses being taught in the contemporary courses, integrating principles of economics and complicated financial models. It demands strong hold of economics and financial concepts to master topics such as financial market, asset pricing, risk mitigation, and corporate finance.

These subjects pose a serious challenge, especially when students face complex questions in exams and other assignments where one has to establish a link between theory and practice.

Students often grapple with questions related to:

- Analysing market structures and their impact on financial decisions

- Applying stochastic models in asset pricing

- Conducting risk assessments in varying economic conditions

- Understanding the implications of fiscal and monetary policies

We specialize in providing financial economics assignment help for students struggling with such questions. Our approach to solving these assignments is very much methodical and client-centered. We guide students in a systematic manner in order to leave no room for confusion of the concepts while strictly following the instructions of the assignment to produce accurate results. Our team of experts helps students develop practical skills of establishing connections between the fundamental theories and real-life problems in finance. We also provide case study and analysis help related to business, finance, and economic issues within an economy.

Conclusion

The financial crisis that hit the global economy in 2007-2008 is a perfect example to showcase the importance of Keynesian economics in dealing with economic downturns through implementing fiscal and monetary policy measures to boost aggregate demand and spending. Keynesian concepts provide a robust framework for financial economics students to get a comprehensive view of the factors associated with economic recession and learning the strategies that the government can adopt the address the issue immediately.

Financial economics assignments and exams often ask students to answer complicated multi-dimensional problems involving concepts like financial market dynamics, risk management and basics of monetary policies. Dealing with such questions are generally difficult for students as they require deep understanding of these concepts.

Our financial economics assignment help service addresses such problem with simplified solutions that acts a self-explanatory guide for students for easy learning. Contact us today and engages with our world class experts and improve your grades.

Helpful References

- Blanchard, O., Dell’Ariccia, G., & Mauro, P. (2010). Rethinking Macroeconomic Policy. Journal of Money, Credit and Banking, 42(s1), 199-215.

- Krugman, P. (2009). The Return of Depression Economics and the Crisis of 2008. W. W. Norton & Company.

- Mankiw, N. G. (2019). Principles of Economics. Cengage Learning.

FAQs

1. What topics in financial economics can you help with?

We assist with a wide range of topics, including market dynamics, asset pricing, risk management, corporate finance, and the impact of fiscal and monetary policies.

2. How do you ensure the solutions are accurate and comprehensive?

All the computations and the application of the theories are well defined with detailed explanation.

3. Can you help with both theoretical questions and practical case studies?

Yes, we assist with theories and solved cases so that the students can interlink the theoretical concepts with practical examples.

4. What is the turnaround time for your financial economics homework help?

We aim at delivering quality help in the shortest time possible. However, the time taken depends on the nature and size of the project.